Not known Facts About Paul B Insurance Medicare Agent Smithtown Ny

Table of ContentsIndicators on Paul B Insurance Local Medicare Agent You Need To KnowNot known Details About Paul B Insurance Medicare Agent Massapequa Ny Paul B Insurance Medicare Agent Huntington Ny - QuestionsThe Paul B Insurance Medicare Agent Plainview Ny DiariesThe Main Principles Of Paul B Insurance Medicare Agent Smithtown Ny Paul B Insurance Medicare Agent Huntington Ny for Beginners

Discovering the very best Medicare Advantage strategy may deserve it for the extra coverage. Make sure to ask the ideal questions to get the most out of the plan you choose. Medical professionals and hospitals in a strategy's network can alter yearly, so it's finest to make certain your family physician is still in the plan after your preliminary enrollment.If you require medications, are they readily available and budget-friendly under a picked strategy? Medicare Benefit prepares limitation how much their members pay out of pocket for covered Medicare expenses.

Our Paul B Insurance Medicare Agent Massapequa Ny PDFs

The plans must follow guidelines and requirements set by Medicare. The federal government pays Medicare Advantage prepares to provide all Medicare-covered benefits. If there is a distinction in between the amount a Medicare Benefit strategy is paid by Medicare and the plan's actual expense to provide benefits, the strategy should use any savings to offer fringe benefits or lower expenses for members of the strategy (Paul B Insurance Medicare Agent Massapequa NY).

Medicare concerns quality ratings for Medicare Advantage plans. Medicare studies individuals who sign up with a Medicare Benefit plan to measure the general quality of the strategies, consisting of quality of care, plan members' ability to gain access to care, strategy responsiveness and member satisfaction - Paul B Insurance Local Medicare agent. Specific Medicare Benefit strategies are ranked on a scale of one to 5 star, with 5 star being the highest score.

With Medicare Advantage plans, you might see changes in the physicians and healthcare facilities consisted of in their networks from year to year, so call your companies to ask whether they will remain in the network next year. There might also be changes to the strategy's vision and dental coverage, along with the prescription drugs it covers, states Danielle Roberts, a co-founder of Boomer Benefits, a Medicare insurance broker.

The Only Guide for Paul B Insurance Medicare Agent Huntington Ny

So examine your advantages declarations and medical bills for the past year, then include up what you paid in deductibles and copays to get the true expenses of your strategy. Then consider what you might pay the list below year, if you require, say, a knee replacement or have a mishap.

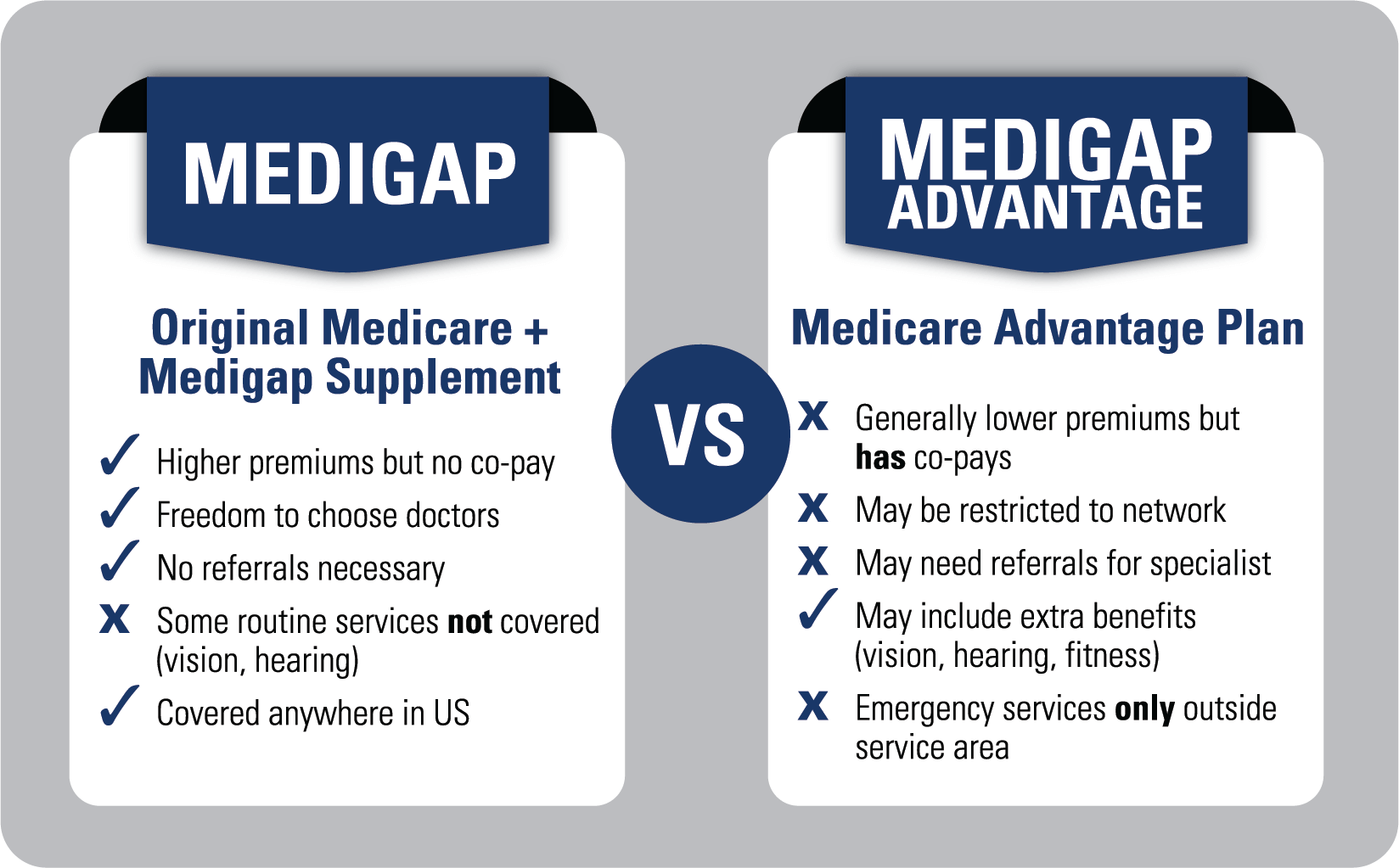

Consider the consequences of switching. When you initially enroll in Medicare at age 65, you have a guaranteed right to buy a Medigap strategy. And insurance providers are needed to renew coverage each year as long as you continue to pay your premiums. But if you shop a Medigap policy after that enrollment window, insurance providers in many states may be able to turn you down or charge you more due to a preexisting condition, Roberts says (Paul B Insurance Medicare Agent Smithtown NY).

The 3-Minute Rule for Paul B Insurance Medicare Agent Smithtown Ny

These strategies are used by insurance business, not Paul B Insurance Medicare Agent Plainview NY the federal government., you must likewise certify for Medicare Components A and B. Medicare Advantage strategies also have particular service locations they can offer protection in.

A lot of insurance strategies have a site where you can check if your physicians are in-network. You can likewise call the insurance provider or your medical professional (Paul B Insurance Medicare Agent Smithtown NY). When deciding what alternatives best fit your budget, ask yourself how much you spent on health care in 2015. Keep this number in mind while examining your different plan alternatives.

This varies per plan. You can see any service provider throughout the U.S. that accepts Medicare. You have a particular selection of providers to pick from. You will pay more for out-of-network services. You can still get eye take care of medical conditions, but Original Medicare does not cover eye tests for glasses or contacts.

The Buzz on Paul B Insurance Medicare Agent Smithtown Ny

Lots of Medicare Benefit plans offer additional benefits for dental care. Lots of Medicare Benefit prepares offer extra advantages for hearing-related services.

You can have other double protection with Medicaid or Unique Needs Strategies (SNPs).

When choosing your Medicare protection, you ought to think about strategy costs, strategy physicians, benefit, your lifestyle and your present healthcare requirements. Your health is crucial to us, and we're proud to offer an option of Medicare Benefit Plans that offer you the detailed coverage you require in addition to the high-quality, local care you should have.

How Paul B Insurance Local Medicare Agent can Save You Time, Stress, and Money.

MA-PDs consists of a growing share of overall Part D enrollment as more recipients pick strategies with integrated medical and drug advantages. A lot of Medicare Benefit enrollees (88%) are in Medicare Benefit prepares that provide prescription drug protection. By incorporating prescription drug coverage with other Medicare benefits in one strategy, MA-PD strategies have the ability to coordinate care and handle expenses across both the medical and drug advantages compared to PDPs.

Despite the rising costs of prescription drugs, Part D strategies have actually been able to provide steady premiums to beneficiaries given that the program's beginning. While there have actually been significant modifications made to the Part D program, there is likewise increasing interest in resolving the expense of prescription drugs, both in Part D and for drugs covered by Part B.